Table of Content

We offer this because we're confident you're going to love working with a Clever Partner Agent. Get the latest real estate news and tips with our free weekly newsletter. Withdrawing from your 401k before you hit retirement age always incurs penalties and fees. There are also different methods for withdrawing from your funding.

The party's representation in the Tweede Kamer, the lower house of Dutch parliament, was expected to argue in favor of this allocation in a debate session on Monday. Replacing the former Down Payment Assistance Program, the First-time Homebuyer’s Program has been extended to March 31, 2019. Available funding of $1.25 million will assist an estimated 100 households secure home ownership. The goal is to help moderate-income home buyers through repayable loans financed through the NLHC and a $2,000 grant for each. Is home to some of the most high-priced real estate markets in Canada, as well as some of the steepest property taxes.

The first-time home buyer incentive

First-time home buyers reached a 2.18 million seasonally-adjusted annual rate in Q4, their fastest pace since 2006. More specifically, the first-time homebuyer market was very active in 2019, according to a new report from Genworth Mortgage Insurance. Nobody expects you to be an expert in mortgage and that’s okay. Homeownership can be an excellent means for building household wealth. Home values increase approximately 7 percent per year, on average, which is why the typical U.S. homeowner has 40x more net worth than the typical renter. The typical Homebuyer.com customer uses about 5 months to find a home.

Some builders will include this cost in the price of the home, and others won’t, so it’s important to clarify this. In either case, you may be eligible for a tax rebate on a portion of the GST or HST you paid as part of the purchase or construction of a new home. There are multiple housing rebates you can claim, and the value of this rebate will vary based on which ones your home purchase qualifies for. One of the biggest challenges for first-time home buyers is saving up a down payment. The purpose of the First-Time Home Buyers’ Tax Credit is to allow you to get a small portion of it back. This tax credit offers a $5,000 non-refundable amount when you file your tax return the following year, which translates to about an extra $750 in your pocket to help cover those new-home expenses.

First-Time Home Buyers’ Tax Credit (HBTC)

This article is a collection of the most important tips for first-time home buyers that I’ve gleaned throughout my career as a lender. What you are about to read is inside information based on 20 years of lending. The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage payments without adding to their financial burdens. A five-hour committee session on the government's housing policy was scheduled to take place from 1 p.m. The agenda includes a review of the housing market, student housing, and the impact of private investors on home prices.

Currently being revamped for 2018, the Home Ownership Program is intended to help facilitate new homeownership for individuals and families in Montreal, Quebec. Households without children are eligible for a lump sum of up to $5,000, and those with at least one child under 18 are eligible for up to $15,000. You’re a first-time home buyer and so is your spouse (the refund will be reduced if one of the purchasers is not a first-time home buyer). Applicants may use a co-signer to qualify for and obtain mortgage approval from a lender.

Students, first-time home buyers need €250 million to fight housing shortage: Greens

In exchange for cash, home buyers agree to live in their home and make payments for five years, at minimum. Across the country, the average first-time homebuyer property costs $137,008, with an average 6% down payment of $8,220. In 2019, the average cost of a home for all buyers was around $244,000.

Let the lender look at everything — your credit score, your income, your savings, and your history of work — it’s for your benefit. Don’t let a lender tell you a pre-qualification is just as good because it isn’t. Mortgage lenders provide pre-approvals to first-time buyers at no cost similar to how architects give estimates on a project or design. They do a check-up and analysis and tell you the results in as little as 3 minutes online. "The environment today is very difficult for the first-time home buyer," Gardner said, adding that if you start out informed, you can be a better partner to your real estate agent.

Generally, you have two years from the date ownership of the house is transferred to you to claim the rebate. You must intend to live in the home as your principal residence. You must have a written agreement to build or purchase a qualifying home. Find AgentsIf you don't love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction.

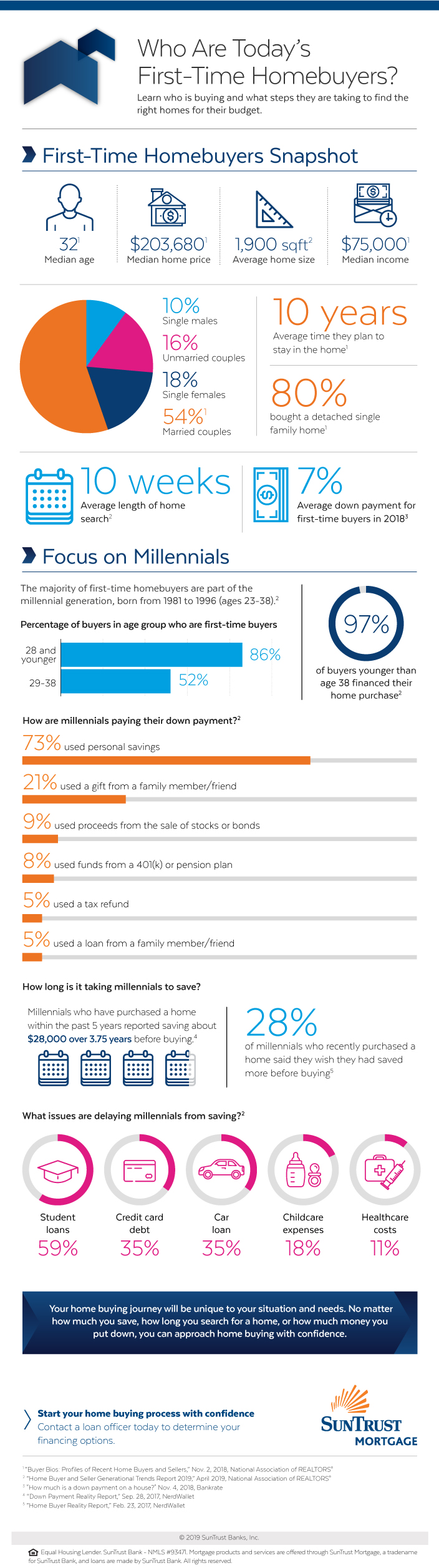

The average median take-home income of first-time homebuyers is $47,952, while the average repeat buyer has $50,479 to spend on a home.This amount varies drastically per state and metropolitan area. This comes from the same down payment analysis that worked out the average first-time buyer demographic and calculated the salary using statistics from the Bureau for Labor Statistics. For total homebuyers however, which includes both repeat and first-time buyers, there are almost double the number of women than men buying property in the country (17% vs 9%).

Similar to B.C.’s First Time Home Buyers’ Program, the Newly Built Home Exemption helps to lower or eliminate the property transfer tax you’re required to pay on a new house. The difference is that this exemption applies to newly built homes, whether or not you’re a first-time buyer. The National Council of State Housing Agencies websitemaintains an active list of closing cost assistance programs. Programs require buyers to meet minimum credit standards and income thresholds and homes to meet the minimum safety and quality standards.

In our down payment for first-time buyers analysis, we also found that the COVID-19 impact varied greatly by metros and state. Therefore, a first-time homebuyer is not just someone about to buy their first home. This distinction is important as these exceptions will feed into the statistics. This page and all contents are copyright, Government of Newfoundland and Labrador, all rights reserved. The calculators and content on this page are provided for general information purposes only. WOWA does not guarantee the accuracy of information shown and is not responsible for any consequences of the use of the calculator.

No comments:

Post a Comment