Table of Content

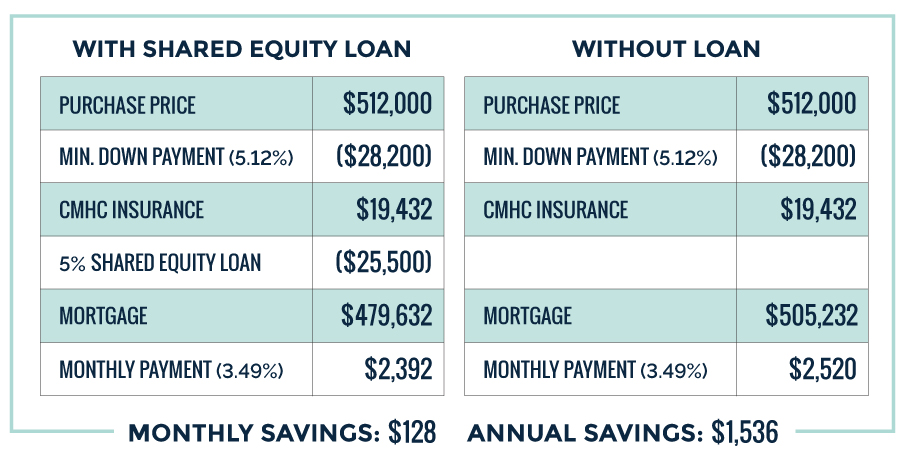

The lowest average age of first-time homebuyers in the last 40 years was in 1991 when it dipped to 28 and it has not been this low since. The below graph shows the average age of first-time homebuyers since 1981, some years are missing as the data was not collected every single year. The program will be extended to March 31, 2019, with available funding of $1.25 million, and will assist an estimated 100 households to secure home ownership. Buying a home is a legal transaction so it’s common to have two real estate agents attached to each purchase. The other real estate agent works for the seller’s best interest. The FHA maintains a list of state and local down payment assistance programs on its website.

A home inspection is an examination of a home’s systems and structure, conducted by a state-licensed home inspector. They provide complete information to a home buyer about the home they’re about to purchase. Inspections can cost between $ , depending on a subject home’s size and the complexity of its fixtures and systems, and are usually completed in 4 hours.

Average down payment on a house for first-time homebuyers

You have a household income to a maximum of $80,000 per year for singles or couples with no dependant children living at home; or, $90,000 per year for singles or couples with dependent children living at home. If the value is between $750,000 and $800,000, you may be eligible for a partial exemption. The amount of tax relief you’re eligible for depends on where you live. For instance, those residing in the Capital Regional District, Greater Vancouver Regional District, and the Fraser Valley Regional District may be eligible for a grant of $570. Home owners residing in other parts of the province may be eligible for a grant of $770.

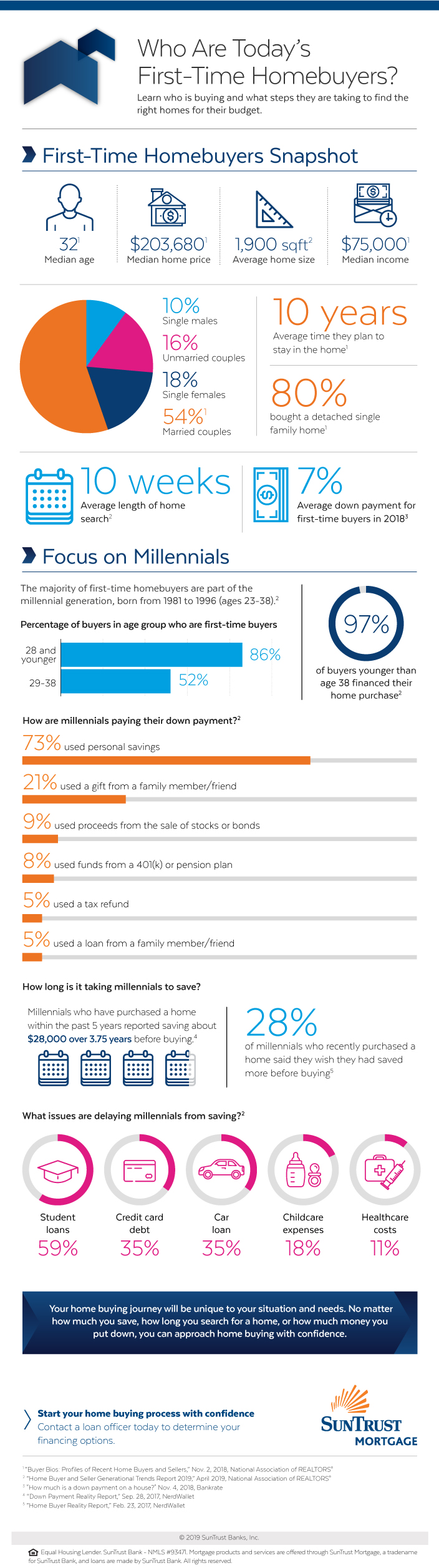

Geographically, 12% of respondents in the South and West are prospective home buyers, slightly ahead of the Northeast (10%) and Midwest (9%). According to NAHB’s latest Housing Trends Report, the share of adults who are considering purchasing a home in the next 12 months fell to 11% in the final quarter of 2019, down from 13% a year earlier. On average, housing prices rose by 21.5% across the country, with the largest housing price change reported in Montana at 41.5%. Of all single males who are purchasing a house in the U.S., 36% of them are buying their first home.

Average size of first-time homebuyers house

Buyers with high credit scores get significant adjustments, too. In late 2022, the Federal Housing Finance Agency discounted interest rates to make homes more affordable for first-time buyers. The Downpayment Toward Equity Actis a home buyer grant that awards up to $20,000 cash to first-generation home buyers, plus an additional $5,000 to buyers with socially or economically disadvantaged backgrounds. Millennials are the most likely generation to be making plans to purchase a home within a year (19%), followed by Gen Z (13%) and Gen X (12%). In contrast, only 5% of Boomers reported plans to purchase a home.

In this article, you’ll find an overview of the programs available nationwide and by province, including a description of each, whom it’s for, and how to apply. We welcome you to reach out to us, and we can help you make sense of the resources available to first-time home buyers. Homebuyer.com offers a nationwide forgivable mortgage through our instant mortgage application.

Share via Email

Repeat buyers will put down an average of 16%, while homebuyers aged years old are likely to put an average of 23% as a down payment, the highest median average of any age group. Six in ten (60%) unmarried couples who are purchasing homes are first-time buyers. This figure is dramatically lower for home-buying Americans who are married with children - only 32% of this group are purchasing their first home. Generally, those who are married parents are three times as likely to have already purchased their first home.

All loans are subject to ID verification and consumer report review and approval. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report. All Certificates of Deposit are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A., Member FDIC.

The $25,000 Downpayment Toward Equity Program

Both these scores would fall under VantageScore’s 'Good' range, which is used in this analysis rather than FICO. One of our recent analyses looked at first-time buyers' down payment amounts, and we found that the average first-time homebuyer down payment amount across the country is $8,220. For repeat buyers, this amount was $51,584 if using a 16% down payment. This is based on a huge variety of datasets, as well as the fact that the average down payment amount for first-time buyers is 6%, rather than the commonly referenced 20%. Buying a first home is typically the largest financial decision and commitment most people will ever make.

Note that for people with disabilities, the four year rule doesn’t apply. If you’re a person with a disability, or the home is being purchased for someone with a disability, you don’t have to be a first-time homebuyer. However, the property must be purchased with the intent of providing greater accessibility.

Before you start the mortgage application process, pull your credit report at AnnualCreditReport.com and correct any mistakes that you find. This is an important step in getting pre-approved (which is much better than pre-qualified) for a mortgage. If the report looks good, it’s time to shop around, which according to the NerdWallet survey is another minefield for first-timers. Half of buyers applied to just one lender, which cost them about $430 in interest in the first year for a fixed-rate $260,000 mortgage. When you run your numbers, you will consider mortgage principal and interest, homeowners insurance, and taxes.

VA loans offer 100% financing for buyers with a 620 minimum FICO score. Home buyers can use VA loans to purchase any residential property in the United States. Buyers with low credit scores and small down payments get the largest interest rate adjustments on their Fannie- or Freddie-backed loans. Combining various datasets, we have plotted estimates of the proportion of first-time homebuyers over time and how many there were in each year since 2000. In 2020, there were an estimated 1,782,500 first-time home buyers.

The method of acquiring the home (i.e. gift, inheritance, purchase) is irrelevant, but if you previously received a home as a gift or through inheritance, you won’t be eligible for this refund. Ontario does not allow you to re-qualify as a first-time homebuyer, as you might be able to do under the Home Buyers’ Plan. All interested Canadian citizens, including City of Edmonton employees, are eligible to apply. Mortgage co-signers do not need to meet the eligibility criteria and therefore do not have to be full time occupants and residents, meet income and net worth criteria. You must be employed and have a combined household income of less than $117,000.

The first-time buyer program would refund up to $15,000 in tax liability to first-time home buyers retroactively to December 31, 2020. Get pre-approved for the first-time home buyer mortgage rate discount. The National Homebuyers Fund is a non-profit public benefit corporation that sponsors home buyers with up to 5 percent of a home’s purchase price.

You must be pre-approved for a 5-year fixed-rate mortgage equivalent to the price of the PEAK housing unit. If you’re purchasing a home jointly with another individual, you can share the tax credit, but you cannot claim two HBTC credits for one property. First-time home buyers who are unable to come up with a down payment can withdraw from their 401ks in order to gain access to funding quickly. When pulling from a 401k, borrowers only have access to the vested amount in their account, rather than the ending balance.

No comments:

Post a Comment